We are exactly one month out from that most American of holidays—Black Friday. To get people even more hyped for their annual, post-Turkey Day consumerism binge, PayPal has announced it is partnering to integrate a Venmo payment option into Amazon checkout services. The rollout is already in progress for American users, and will be reportedly available to all 90 million Venmo customers in time for the holiday shopping season via both Amazon.com and the Amazon mobile app.

[Related: Venmo just updated some of its privacy features.]

“Whether it’s restocking household essentials or purchasing a last-minute gift, we know that Venmo users shop over two times more frequently than the average shopper and are 19% more likely to make repeat purchases,” reads the announcement, citing a study from Netfluential and Edison Trends.

PayPal first hinted at an integration with the e-commerce giant almost exactly a year ago, but did not offer a timeline for the services’ pair-up. In addition to standard acceptance for credit, debit, and gift cards, Amazon also partnered with Affirm last year to support breaking up larger transactions into monthly payments.

[Related: Why do we go Black Friday shopping?]

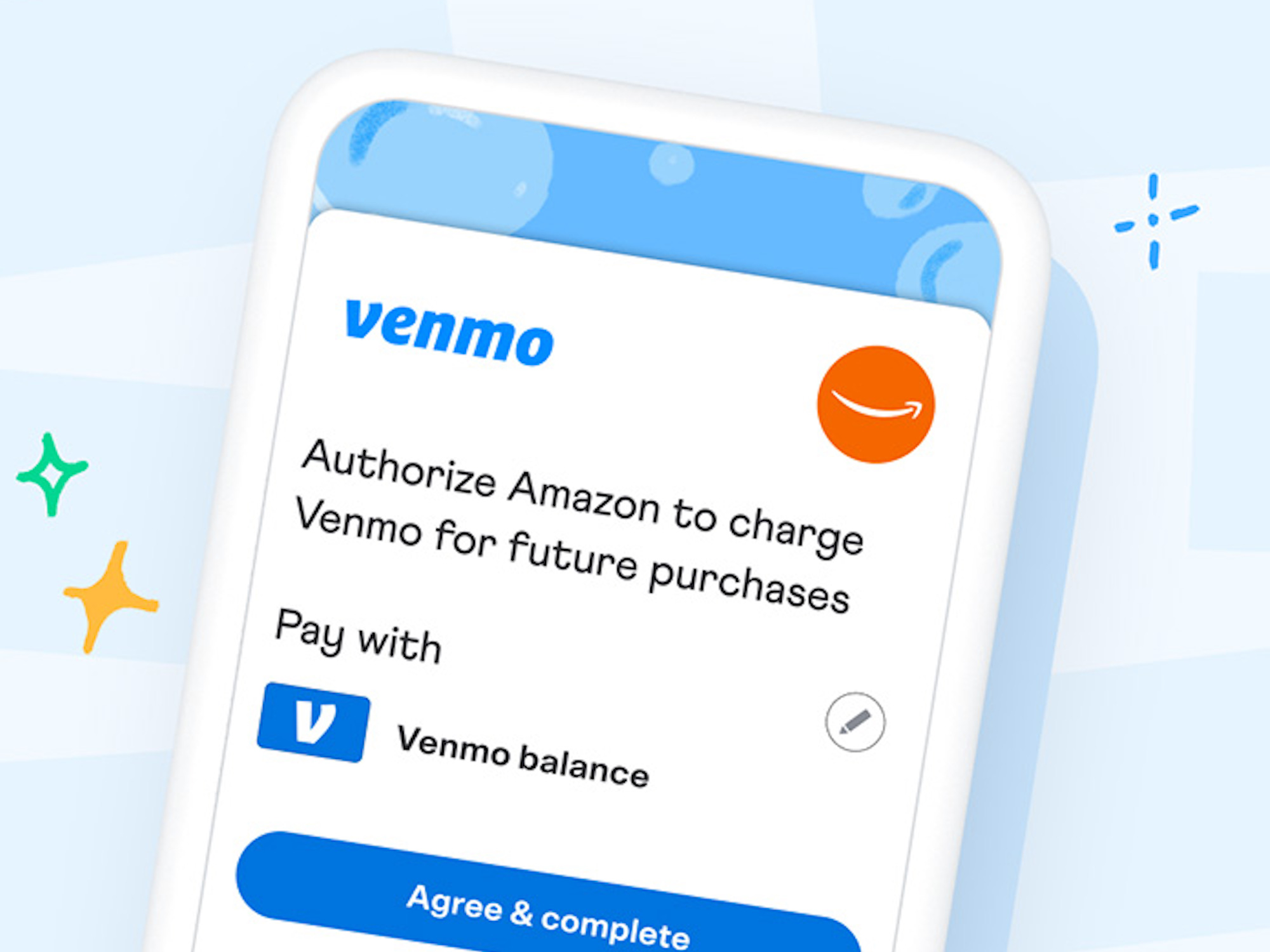

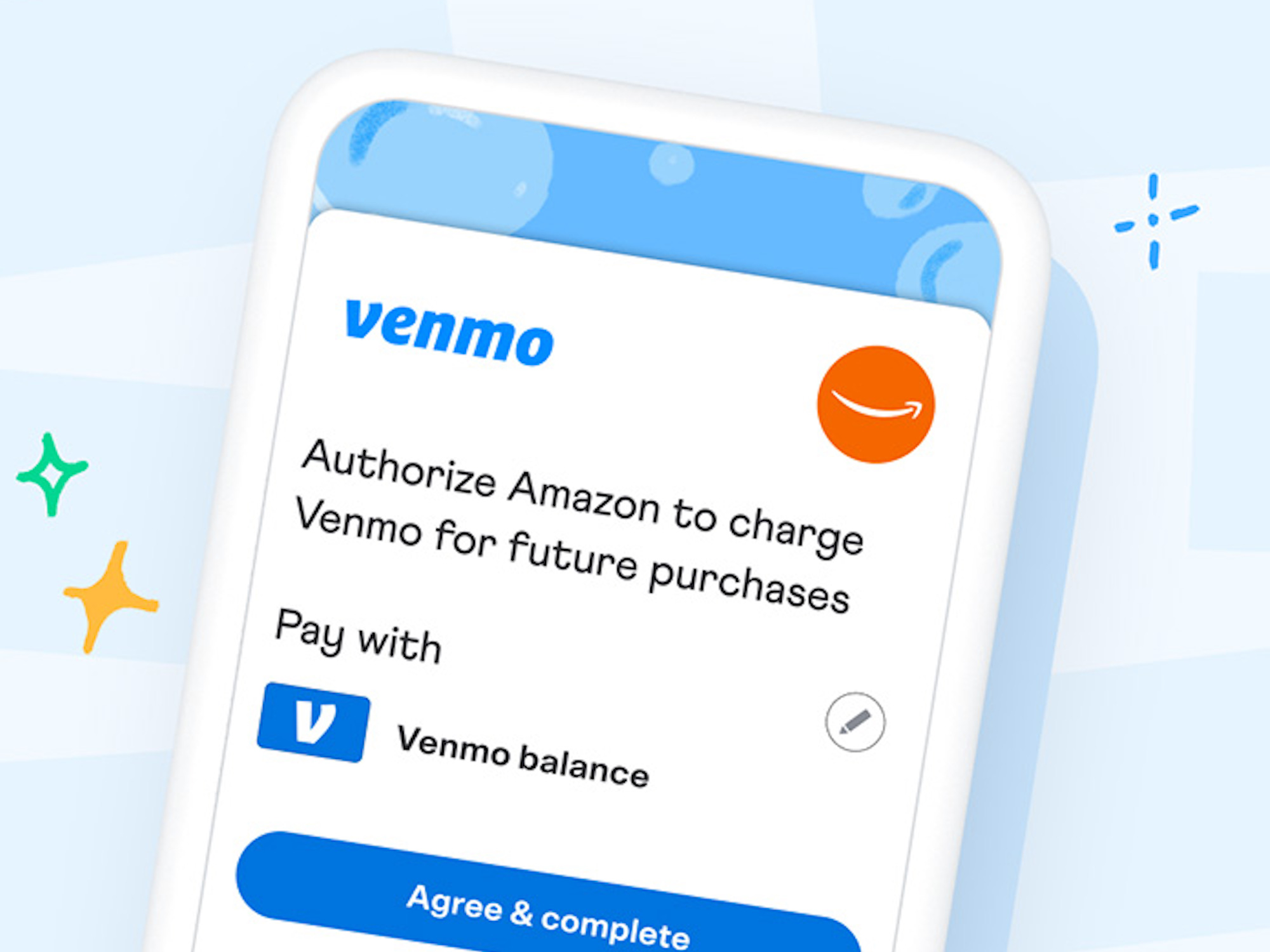

Once updated, Amazon customers will see the option to add Venmo as a payment option during checkout. Choosing this option will automatically open the Venmo app, at which point users can opt to allow Amazon the charge the account for future purchases. From there, purchasers should see a confirmation screen that also lists the option to set Venmo as your default payment method for all ensuing items, a preference that can switched at anytime via selecting “Settings” and then clicking the “Connected Businesses” option in Venmo’s app.

Amazon’s Venmo support comes at a time when the business giant is increasingly showing an interest in the private financial sector. Last month, the company announced an “instant pay” system for all employees across its operations, corporate, and technology departments that allows workers to withdraw 70 percent of their eligible earned income whenever they want.