This post has been updated. It was originally published on 11/2/2017.

Many smartphone apps will ask you to pay a monthly or a yearly subscription and automatically deduct that money from your financial account of choice. From video-streaming services like Netflix to weather-monitoring apps such as Dark Sky, this model lets you buy into a program with easy recurring payments.

The problem is that, as these apps add up, it’s easy to lose track of how much cash you’re shelling out each month. Add in all those free trials you signed up for and then forgot to cancel before the first billing date, and you can end up spending way more than you intended. Although the task of sorting through all your subscriptions may seem daunting, you can run an app audit in only a few minutes. Here are the simplest ways to go about it.

Check with your app store

If you’ve subscribed to something through the iOS App Store or the Google Play Store, you’ll have used the payment credentials you registered with Apple or Google. And that means they’ll have records of any recurring payments. Reviewing these records lets you quickly see how much you’ve been paying and whether you should consider canceling any given subscription. However, this technique won’t cover anything you subscribed to online or through a computer.

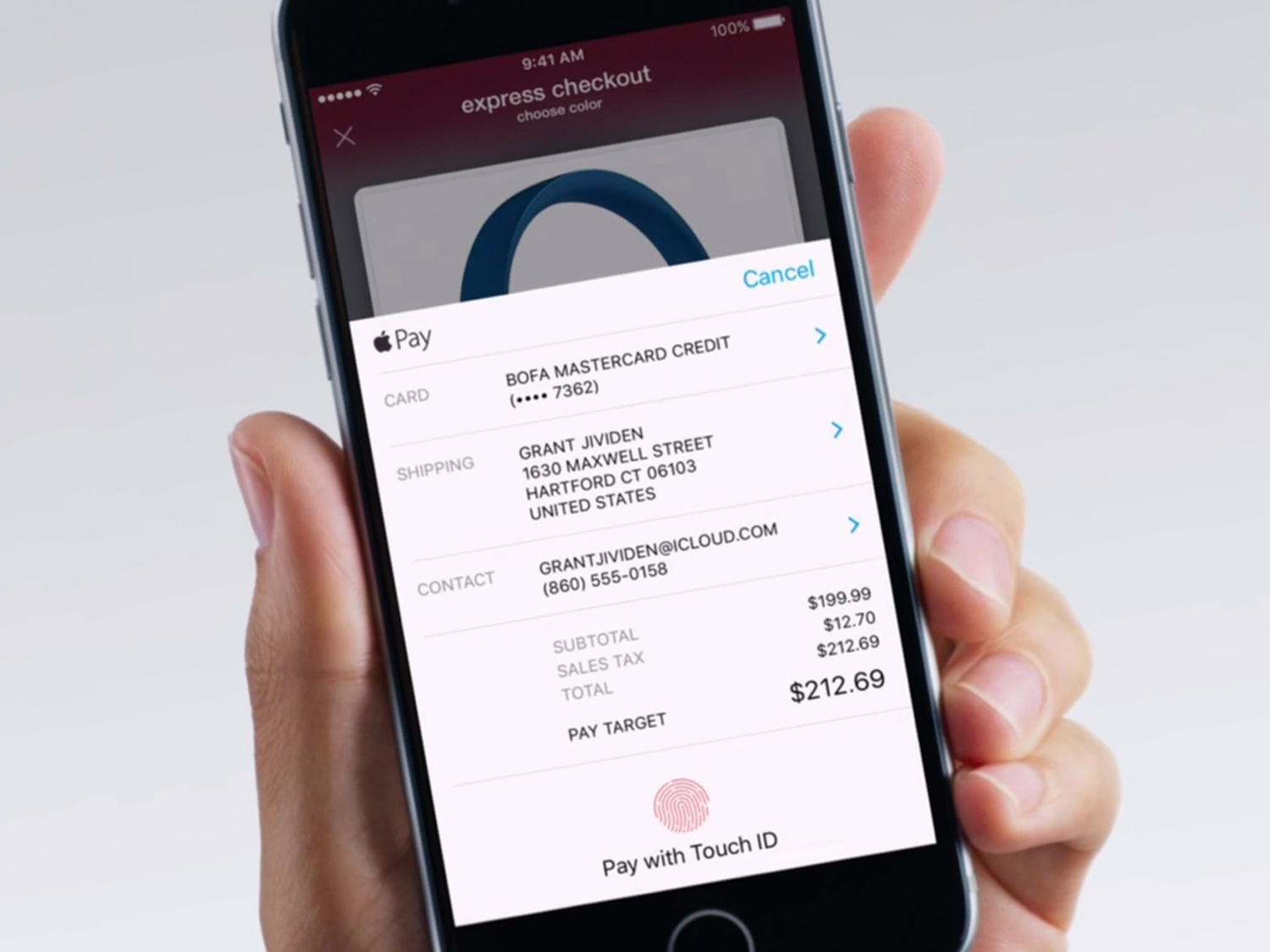

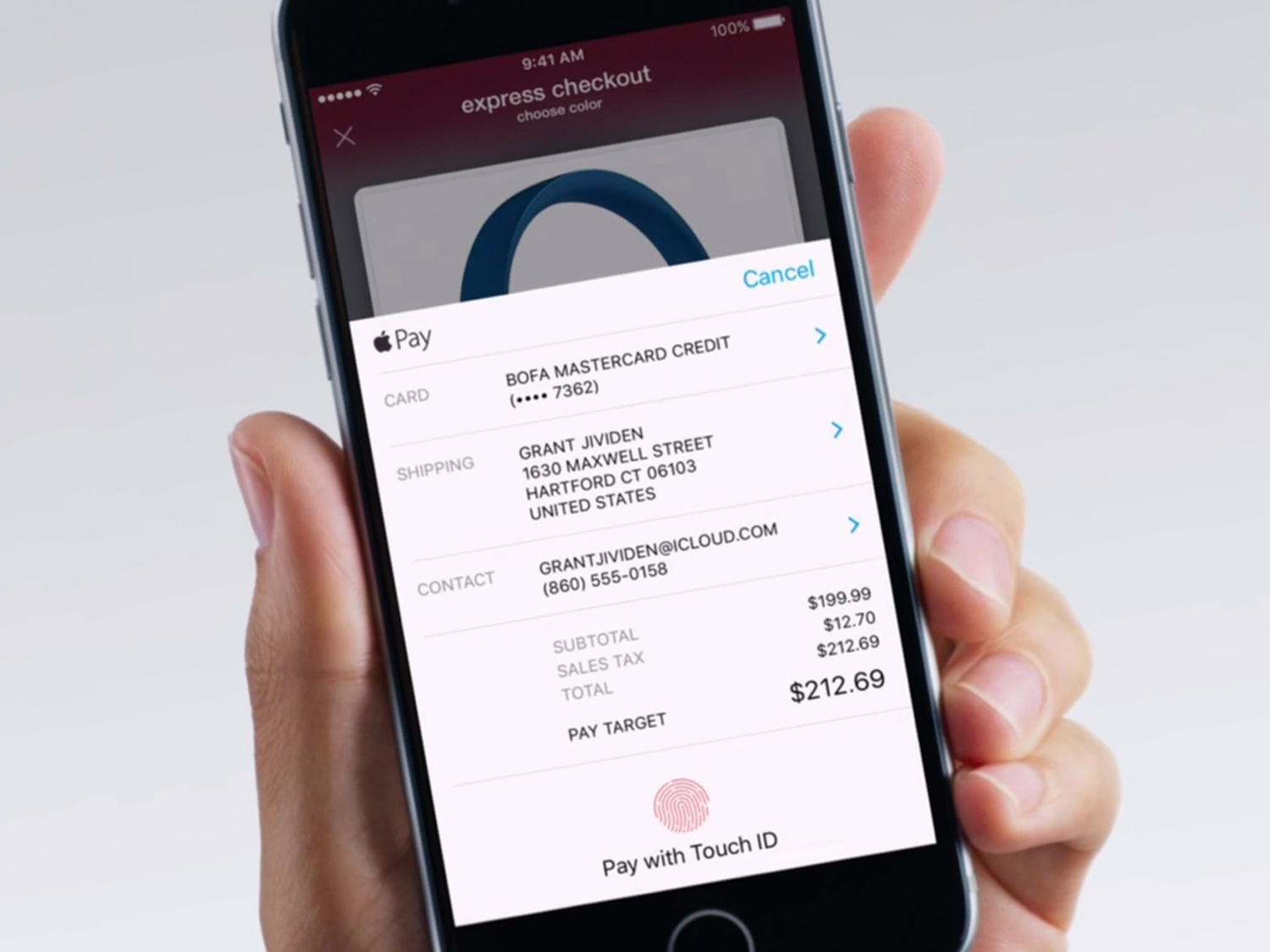

To view and manage your Apple subscriptions, head to the Settings app on your iOS device, then tap your name, followed by iTunes & App Store. Hit the Apple ID link at the top, then View Apple ID, and Subscriptions. The next screen will show you all the subscriptions handled by Apple, including Apple Music. If you decide to cancel any of them, you can do so from this screen.

To view and manage your Android subscriptions, open the Google Play Store app on your device, then tap the menu button (the three horizontal lines in the top left), then choose Subscriptions. You’ll see a list of all the subscriptions, such as Google Play Music, handled through Google. You can cancel them from here, too.

Review emails and bank statements

To audit everything you didn’t get through the Apple- or Google-managed app stores—such as that YouTube subscription you signed up for on your laptop—you’ll need to dive into your email archives, bank statements, or both.

Any honest subscription service will email you each time it takes a recurring payment. So keep an eye out for these and star or highlight them when you see them. It’s also a good idea to star or highlight emails when you sign up for a free trial—and to make a note of when you need to cancel. A quick inbox search for “free trial,” “payment,” or “subscription” might bring up some services you’ve forgotten about.

If all else fails, the cold, hard reality of your bank statements is the place to go. Run through a month of records and see if there are any outgoing charges related to apps and services that you no longer use. Once you’ve identified them, you should be able to cancel these subscriptions from the app or website that’s charging you.

[Related: Pause your iTunes subscription and music-streaming services]

Download app help

With so much happening every day, it can be tricky to stay on top of all your financial credits and debits. So download an app that helps you stop wasting money on other apps.

For example, when you connect the free service Truebill (on Android and iOS) to your bank account, it will show you all your subscriptions and recurring payments in one simple list. It even tracks changes in subscription rates for you, letting you know each time Netflix decides to hike its prices.

Trim works along similar lines, but you operate it by text and online rather than through an app. Again, you can instantly view your subscriptions: With your permission, Trim will look at your bank statements and spot the regular payments that go out monthly or yearly to programs like Dropbox.

Truebill and Trim are lightweight apps designed to tackle recurring payments you no longer want to make. If you want the same service, but but bundled with more comprehensive banking and financial help, try Miwnt or Marcus Insights. These will highlight subscriptions for you, but will also help you set budgets, track incoming payments, and more.

Restrict in-app purchases

You can make one final check to reduce the amount of cash you’re spending on apps: Limit the allowable in-app purchases. If you’re sharing your device with children, this option will be particularly useful.

On any Apple device, head to Settings, Screen Time, and Content & Privacy Restrictions. Next, hit the toggle switch to enable restrictions, then go to iTunes & App Store Purchases, In-app Purchases, and check off Don’t Allow. If you’re looking for a bit of extra security on these settings, you can choose to Use Screen Time Passcode on the main Screen Time page, and then check Always Require a password within iTunes & App Store Purchases. Even if you don’t have little ones playing on your phone or tablet, this adds another barrier to impulsively or accidentally spending more than you intended to inside an app.

Over on Android, you can apply a similar restriction on in-app purchases by opening the Play Store app and tapping the menu button (three horizontal lines on the top left). Choose Settings, then Require authentication for purchases. You can also tell it to ask for authentication every 30 minutes, with every purchase, or never. Once you’ve changed this setting, you’ll need to enter your device PIN or pass a fingerprint test whenever you want to make in-app purchases. Again, this won’t completely block you from spending money inside apps, but it will encourage you to pause and possibly reconsider before purchasing anything.