Learning how to use Google Pay is easy, whether you have an Android device or an iPhone. The Big G’s digital payment platform lets users pay for products and services online and in stores, send money, and save loyalty cards all in one app.

With online shopping and contactless payments becoming more popular, Google Pay has become an important tool for people who want a safe and easy way to manage their money. It makes paying easier and gives you extra perks like rewards and savings, making it a great alternative to other payment platforms, such as Apple Pay.

How to set up Google Pay

To use Google Pay, you must have an active Google account. If you don’t, create one.

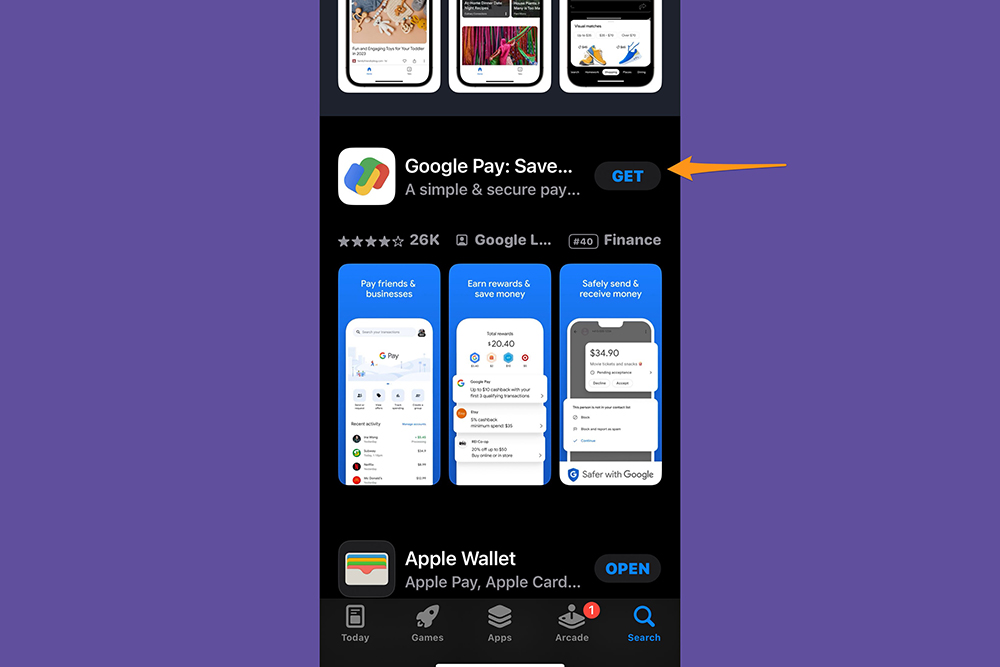

1. Download the Google Pay app from your phone’s app store.

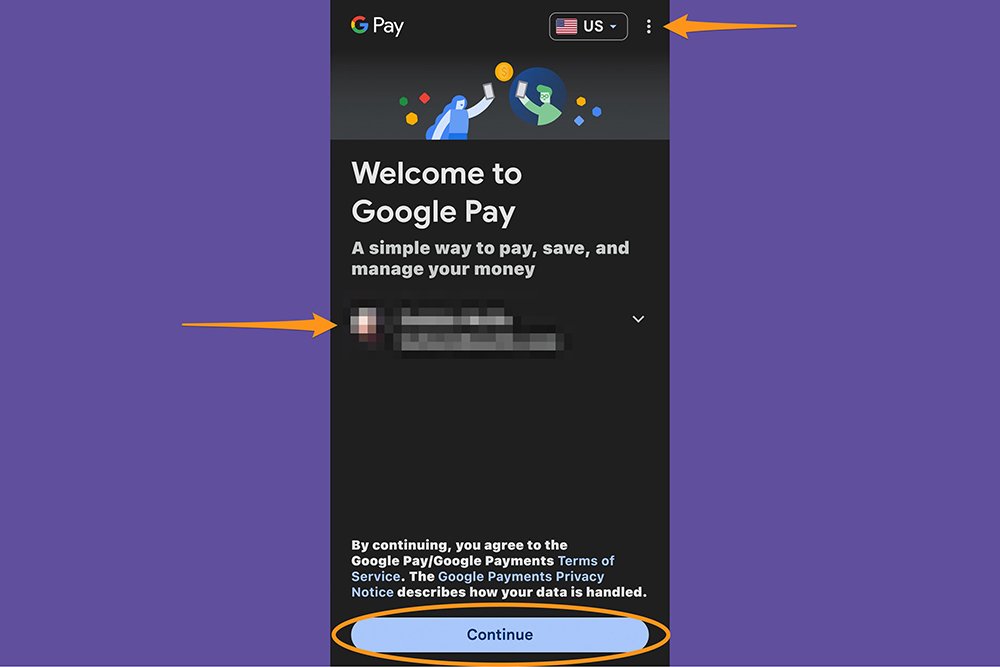

2. Open the app. Select your country in the upper right corner, then sign in with your Google account. Tap Continue and set up your privacy preferences—you can let people find you only by your phone number, and make your transactions public, if you want. But if you don’t feel like getting into it right away, you can also select Not Now and adjust the preferences later in your Google account.

3. You must add a payment method by linking your debit or credit card, bank account, or PayPal account to your Google Pay account. Tap Add an account (iOS) or Link account (Android).

- Note: If you’ve already added credit or debit cards to your phone’s native wallet app, Google Pay might automatically add them to the app.

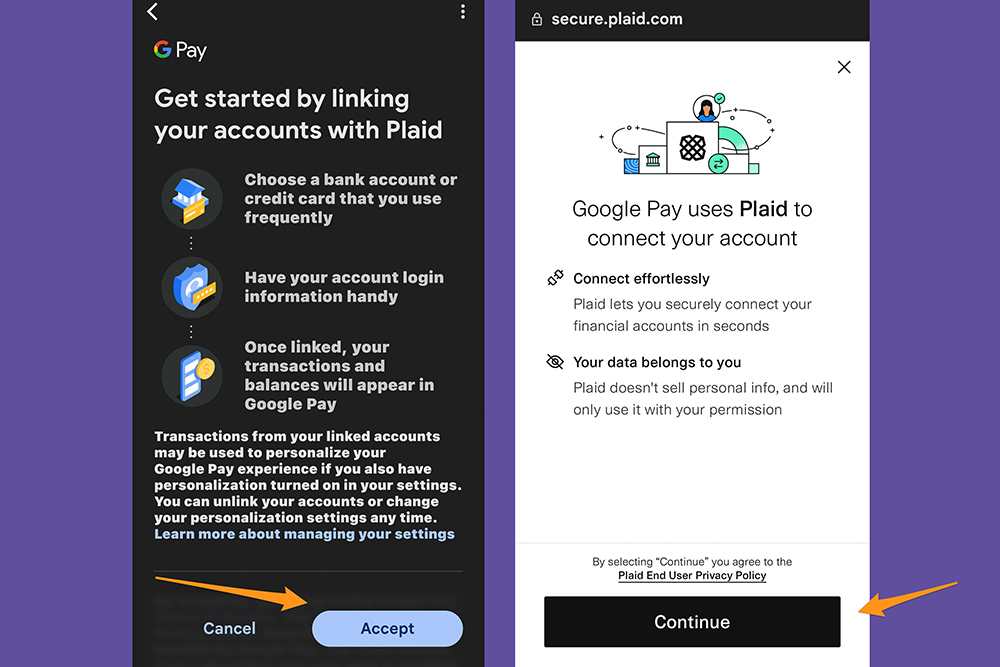

4. Google Pay uses Plaid, a third-party service, to obtain transaction and balance information from your accounts. Select Accept to agree, then Continue on the next screen.

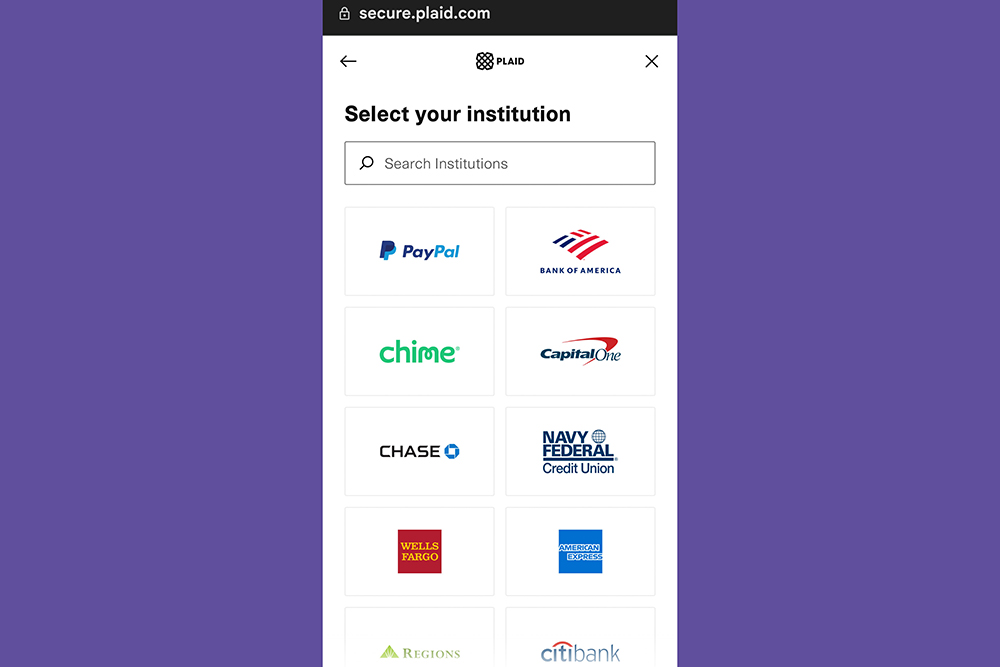

5. Select your financial institution from the short list or type its name into the search bar at the top if you don’t see it listed. When you find it, select it and log in.

6. If the app is able to connect to your bank, the platform will let you know your account was successfully added. Tap Continue to finish. You’re all set—you can use Google Pay immediately.

How to send and receive money with Google Pay

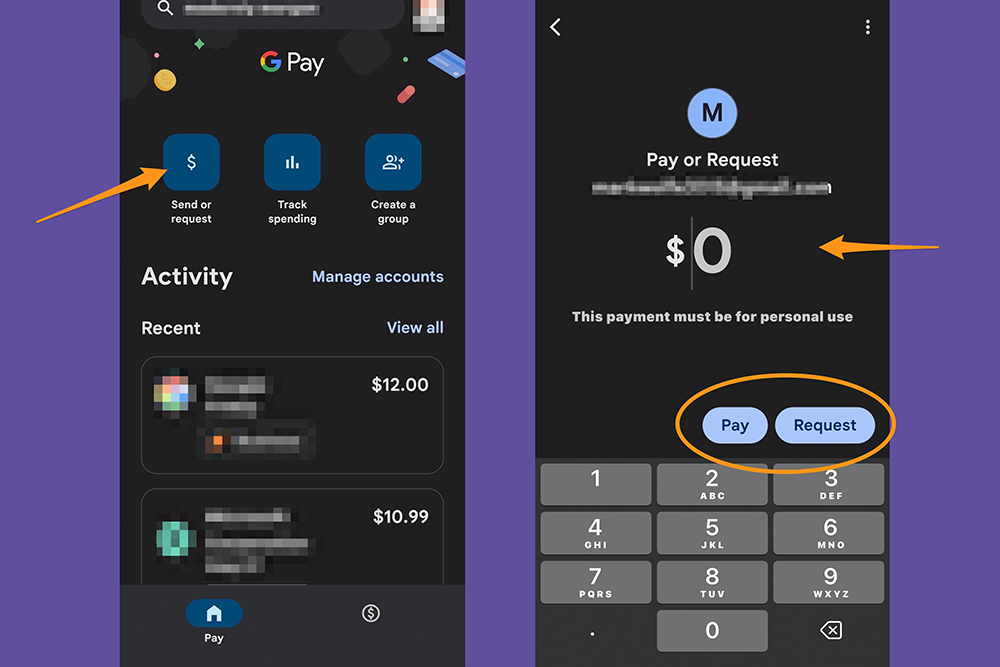

Once you link your bank account or debit card to the app, you can easily pay your friend back for last Sunday’s brunch—just tap Send or request, select the person you want to send money to, enter the amount, and confirm the transaction. You can also request money from others by entering their email address or phone number.

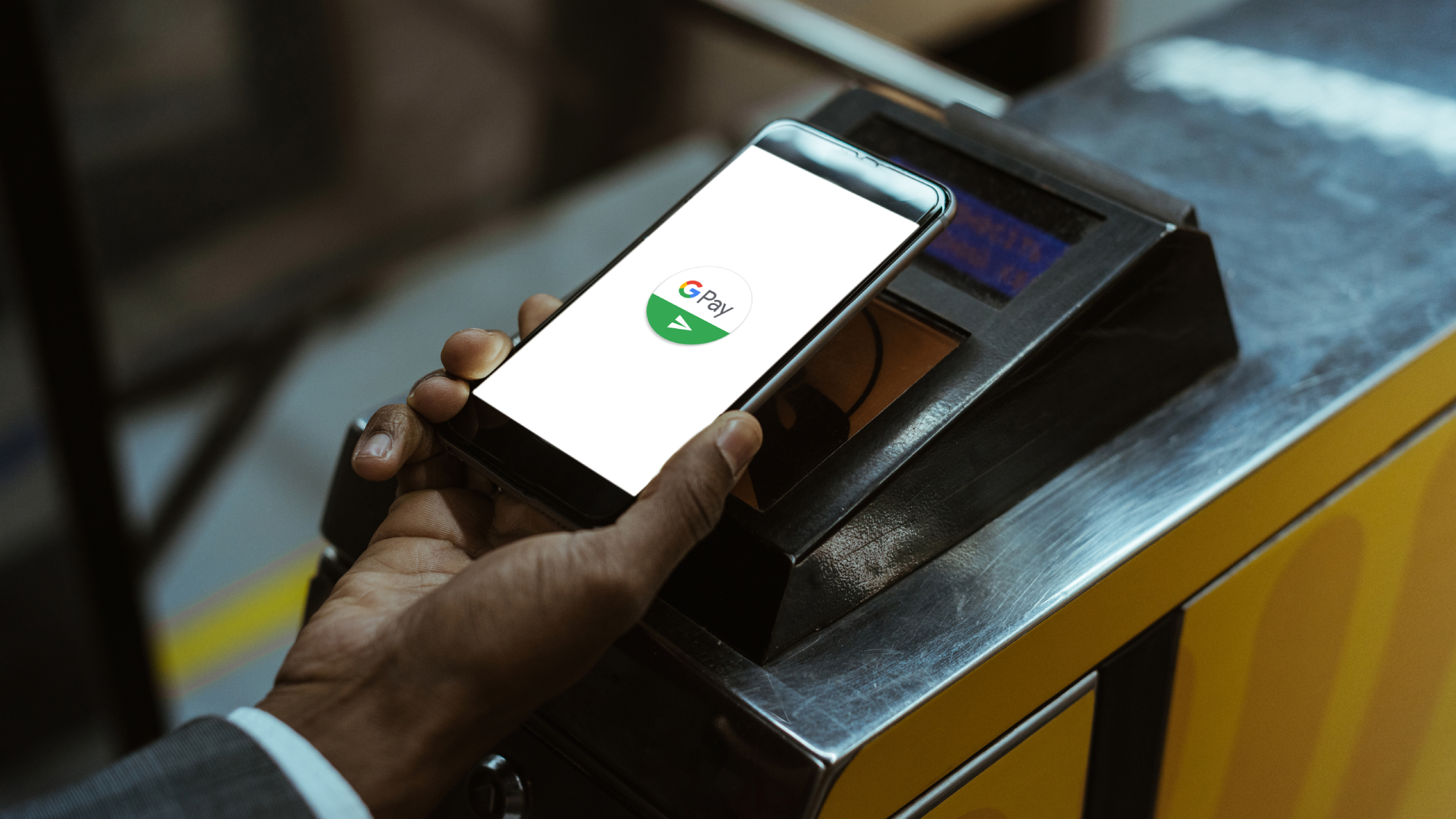

How to use Google Pay in stores

iOS and WatchOS

Once you’ve set everything up on your iPhone or Apple Watch, you can use Google Pay without opening the app. All you have to do is unlock your Apple device, hold it near a contactless payment terminal, and follow the instructions on the screen. Your gadget might ask you to authenticate the transaction via FaceID or by providing your fingerprint, or pressing the lock screen button. Note that you can’t add a gift card to Google Pay on iOS, as that feature is only available for the Android version of the app.

Android

Google Pay doesn’t come downloaded by default on Android phones, so you’ll have to download it and set it up. Once that’s done, you can pay without opening the app—just unlock your device and hold it close to a contactless payment terminal.

How to use Google Pay for online and in-app purchases

Figuring out how to use Google Pay for in-app and online purchases is simple—just look for the right payment option at checkout. Select it, choose the card you want to use for the transaction (if you’ve added more than one) and follow the instructions.

[Related: 4 good international money transfer apps]

If you’re using a credit card, you might have to confirm the security code (CVV) at the back of your card. If prompted, finish by authenticating the purchase using your device’s security measures. Keep in mind that not all vendors support Google Pay, so if that’s your only available payment method, make sure the website or app is compatible before filling up your cart.

FAQs

Many businesses, including websites, apps, and physical stores accept Google Pay. On the web and on your phone, look for the Google Pay option at checkout. When you’re in a store, look for contactless payment options or for the Google Pay logo—you’ll usually find it by the register, the door of a business, or on the payment terminal screen. Additionally, you can use Google Pay for peer-to-peer payments between individuals, just like Venmo, PayPal, or Chime.

You don’t need to link your bank account to use Google Pay—you can just add a debit or credit card, though that will only work to pay merchants directly. If you want to use the app to send or request money, you will need to link a bank account.

If you don’t have a bank account at all, you can still use Google Pay. Instead of a credit or debit card, just link the platform to a prepaid card to make payments online and in store.

Google Pay is safe. It uses multiple layers of encryption to protect user information and offers features like biometric authentication to enhance security. Additionally, Google Pay does not store actual card numbers, reducing the risk of fraud in case of phishing or data leaks.

Google payment methods vary depending on the country and the specific payment method used. There may be a daily transaction limit for international transfers. It is best to check with your bank or Google Pay’s support for the most accurate information regarding limits.

Google Pay does not support cash withdrawals. It’s designed for making digital payments and transferring money to others electronically.

Google Pay is a digital extension of your traditional payment methods, so it operates under the same rules. This means that if you link your debit card to Google Pay, the platform will act like a debit card and apply charges directly to your checking account as you’re spending—no matter if you’re sending money to someone or paying for an in-app purchase.

Google Wallet is available only for Android devices and it allows users to save digital working copies of credit and debit cards, concert tickets, boarding passes, and even your COVID vaccination card. You can use it to shop in-store by placing your phone near a contactless payment terminal. Meanwhile, Google Pay (available for Android and iOS) is a more comprehensive money management platform. It allows for peer-to-peer payments as well as purchases both online and in-store, and—on Android devices—it connects directly with Wallet to use added payment methods.