PayPal will now pay you interest, and offer other bank-like features

The new PayPal app has features for savings, direct deposit, in-app shopping tools, bill pay, and crypto.

PayPal’s app has a new look. The digital payment and financial technology company announced on Tuesday that its latest update will introduce new features and services for its users, such as access to an interest-earning savings account, in-app shopping tools, deals and rewards, early access direct deposit, and bill pay.

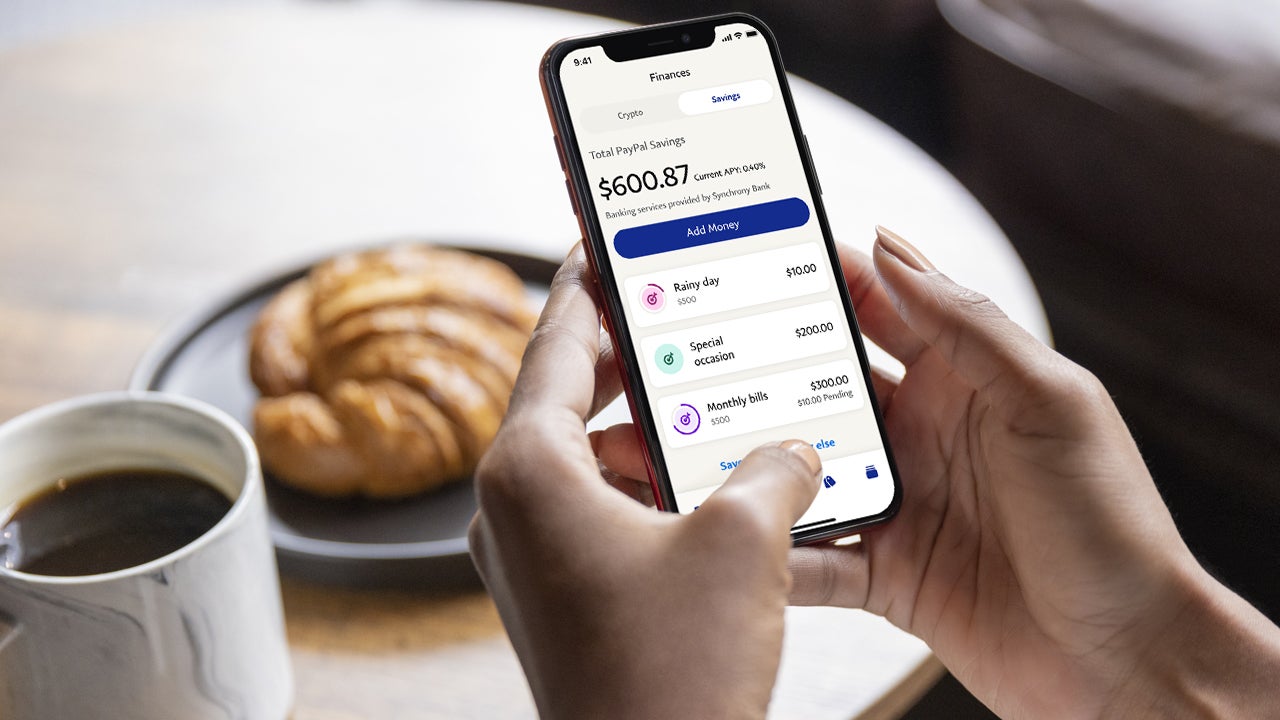

Most notably, PayPal is partnering with Synchrony Bank to offer its customers savings accounts with “PayPal Savings.” Users can easily move money between their PayPal Savings and PayPal balance to make payments. There are no minimum balance or monthly fees required for these accounts, and they will have a 0.40 percent Annual Percentage Yield (APY), which the company says is competitive compared to the national averages. And like a regular bank, PayPal will provide interest payments to customers at the end of their statement period monthly. Users will have early access to direct deposit through PayPal’s bank partner, and they can choose to add all or a portion of their paycheck to their PayPal Balance account electronically.

PayPal has designed accompanying tools that its customers can use to create and track their savings goals. Customers in the US will start seeing this feature pop up in the coming months.

[Related: Venmo just made some big privacy changes—here’s what to know]

PayPal also said that it plans to add investment capabilities and more ways to pay with the app online and in-store (such as with QR codes, or in offline mode) to future versions of the app.

Here’s where to find everything. When you click on the app to launch it, you’ll arrive at the homescreen, which is a personalized dashboard of your account that spotlights your recent activities and recommended deals. Reach the wallet tab by clicking on the bottom panel icon that looks like rectangles stacked on top of each other. In the wallet tab, you can manage banks and cards, as well as direct deposit.

Navigate to the finance tab by clicking on the icon that looks like a bar graph to access savings, and buy or sell crypto. The dollar sign icon leads you to the payments hub where you can send and receive money, international remittances, donations, and pay bills. Like with its subsidiary Venmo, PayPal is adding a two-way messaging feature that lets users send customized notes along with transactions.

From money-mover to full-service finance

PayPal has evolved from a simple money-moving service to a multi-utility finance app. The company calls its new app “an intelligent digital wallet” that the company says is powered by an internal artificial intelligence and machine learning to create a personalized experience for each customer. These include understanding what types of deals appeal to a specific customer. Digital wallets are software-based systems that can securely store a user’s payment information and passwords for several payment accounts.

PayPal estimated that 4.4 billion people globally will use some sort of digital wallet by 2025, and they wanted to be the “all-in-one app” that becomes the primary destination for customers to view and manage all of their financial needs. To boost their wallet offerings, PayPal will be introducing a range of tools to help users with shopping and paying bills.

[Related: What exactly is a digital dollar, and how would it work?]

Its shopping tools will gather discounts and deals from hundreds of PayPal merchants, and you will see these pop-up as you go through the in-app browser. Deals can be saved to the digital wallet, like you’re virtually clipping a coupon, and presented at checkout. There will also be a new loyalty program that customers can sign up for to earn rewards redeemable for cash back and PayPal shopping credits for purchases completed through the platform. This new tech is likely bolstered by PayPal’s acquisition of the web-crawling, deal-finding browser extension: Honey.

With Bill Pay, users can use the app to track and pay an assortment of bills from thousands of companies including those for utilities, TV & internet, insurance, credit cards, phone, and more. Customers can set reminders for upcoming payments, or schedule auto-pay options.

These tech renovations follow PayPal’s report of a strong second quarter in late July. In its report, PayPal laid out plans to launch a string of new experiences to improve business-to-business, business-to-consumer, and peer-to-peer payments. Additionally, it will extend some of its more popular features across brands.

[Related: Bitcoin is having a bumpy rollout as an official currency in El Salvador]

For example, its cryptocurrency services, which it first rolled out in October 2020, will become available through Venmo. Venmo, like PayPal, becomes your custodial wallet for crypto, and you can view cryptocurrency trends, buy or sell the currencies, and learn more about what it is through videos, guides and FAQs. There are four types of cryptocurrencies available through PayPal and Venmo: Bitcoin, Ethereum, Litecoin and Bitcoin Cash. Currently, crypto cannot be transferred to other accounts, but you can swap it for dollars based on the current exchange rate at checkout. There are no fees for holding crypto, but PayPal charges a transaction fee whenever you convert, buy, or sell these assets. Recently, a PayPal executive confirmed to Coindesk that Venmo and PayPal will allow third-party wallet transfers for crypto in the future.