What’s the best money-management tool out there? It may just be your phone. From sticking to a monthly budget to cancelling recurring subscriptions, applications can help you take control of your finances.

The apps we’ve picked out run the gamut from complete financial managers to specialized budgeting tools. Check out the list to pick the ones that best meet your needs. In addition, your bank probably offers its own phone app (or two), which may have even more capabilities.

1. Spendee

Spendee tracks every dollar that flows into and out of your bank account so you can see exactly how much you’re earning and spending. It connects directly to your bank and categorizes all your account activity, including the cash you withdraw and spend.

This tracking allows the app to give you an overarching view of your financial activity. You can see the categories where you’re spending the most cash and the inroads you’re making on your designated budget. Spendee even puts together some delightful graphs and visualizations to better demonstrate how you’re using your money.

On top of that, you can receive reminders to pay your bills, share digital “wallets” with friends and family to track your budgets in tandem, and even work with multiple currencies.

You can get the basic version of this app for free on your phone or within your web browser. However, to access some of Spendee’s best features—including managing multiple specialized budgets and syncing bank transactions automatically—you need a Plus or Premium account, which costs, respectively, $2 or $3 each month.

Spendee for Android and iOS, free with premium plans for $2-3 per month

2. Clarity Money

Like Spendee, Clarity Money connects to your regular bank accounts and analyzes the cash moving in and out. While it doesn’t offer the same comprehensive budget planning and tracking, this app does make smart suggestions for how you can save money.

For instance, Clarity Money can highlight recurring withdrawals for subscriptions that you’re no longer using, and recommend that you cancel them. It can also dig up deals to help you save money on expenses like your phone bill. In addition, the app can help you stick to a certain level of spending or saving. Finally, it lets you create a Clarity Money savings account within the app itself.

Overall, the app is intuitive and easy to use, with a great-looking user interface. And the automatic money management can genuinely save you some dough. Even better, the app is free, but you should brace yourself for a recommended credit card or two: Clarity Money’s developers get their earnings from referral fees on various financial products.

Clarity Money for Android and iOS, free

3. Penny

Penny leverages the power of AI to manage your finances. Although it monitors your bank account activity much like the other apps we’ve discussed, it lets you chat about this information with a bot rather than browsing through charts and menus.

The eponymous Penny bot will send you notifications about your spendings and earnings, monthly summaries of your bills, and breakdowns of your spending by category. To set goals or doing anything else inside the app, make your request via an instant message to Penny.

Depending on how you feel about the chatbot approach, you may love or hate this app. But if conversing with a robot bank manager works for you, Penny is a fantastic choice. The basic version is free for you to try out, but to access premium features like additional spending categories and real-time balance updates, you’ll need to pay $5 a month.

Penny for Android and iOS, free with a premium plan for $5 per month

4. You Need A Budget

You Need A Budget (YNAB) focuses on your spending to help you account for what you buy and reach your saving goals. Before the month gets underway, the app has you set budgets for various categories like clothes and eating out. This prompts you to be more deliberate with your money, even if you end up making adjustments to the budgets as you go.

YNAB aims to help you pay off your debts so you can start saving and stop living from paycheck to paycheck. However, even if you don’t have a drastic savings or debt-payment goal, it can come in handy. For example, the app can sync with your bank account to create reports on exactly how you’re spending your money.

A subscription to YNAB costs $7 a month, but you can try it free for 34 days. This payment lets you access both mobile and web versions of the app.

You Need A Budget for Android and iOS, $7 per month after a 34-day free trial

5. Mint

Mint is an all-encompassing financial assistant for your phone, tracking your bank activity so you can see at a glance where your money is going. On top of that, the app checks your credit score regularly, sends alerts about bill payments, and provides extensive budgeting options that let you set spending goals and check your progress.

Going beyond some of the standard money-management apps, Mint will also warn you about any unusual charges on your bank account and give you personalized spending tips. And it performs all these tasks without requiring much maintenance on your end. Just check that Mint is compatible with your bank account so you can take advantage of its useful automatic-sync feature.

Mint offers both mobile and web apps, and it is completely free to use. In exchange, it occasionally bugs you with offers for credit cards and savings accounts, for which it receives referral fees.

Mint for Android and iOS, free

6. Wallet

Wallet boasts perhaps the most tools we’ve seen in any lone money-management app. In addition, it offers excellent international support and is compatible with a wide range of banks (so you can use its automatic account-syncing feature). And it packs all these services into an accessible, colorful interface.

Like Spendee and Mint, Wallet aims to be a one-stop shop for handling your finances. It tracks your spending, plans bill payments, helps you stick to budgets in multiple categories, identifies unnecessary recurring charges, and more. The app manages to hit a nice balance between comprehensiveness and complexity—it’s a good middle ground for those who don’t want to do everything themselves but still want some control over budgets and spending reports.

You can use the app, which comes in mobile and web versions, for free. But to access some of the features, including wallet sharing and bank syncing, you need to pay at least $2 a month.

Wallet for Android and iOS, free with premium plans starting at $2 per month

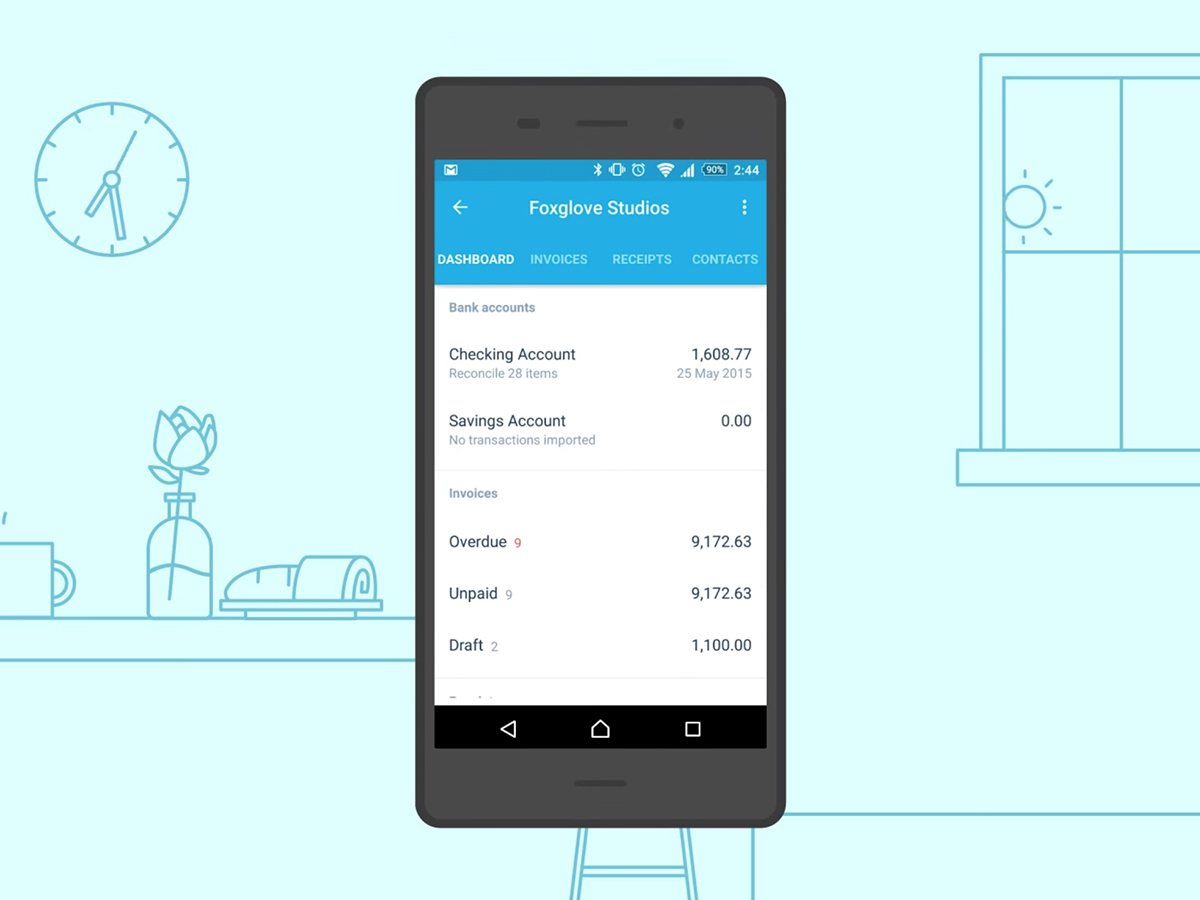

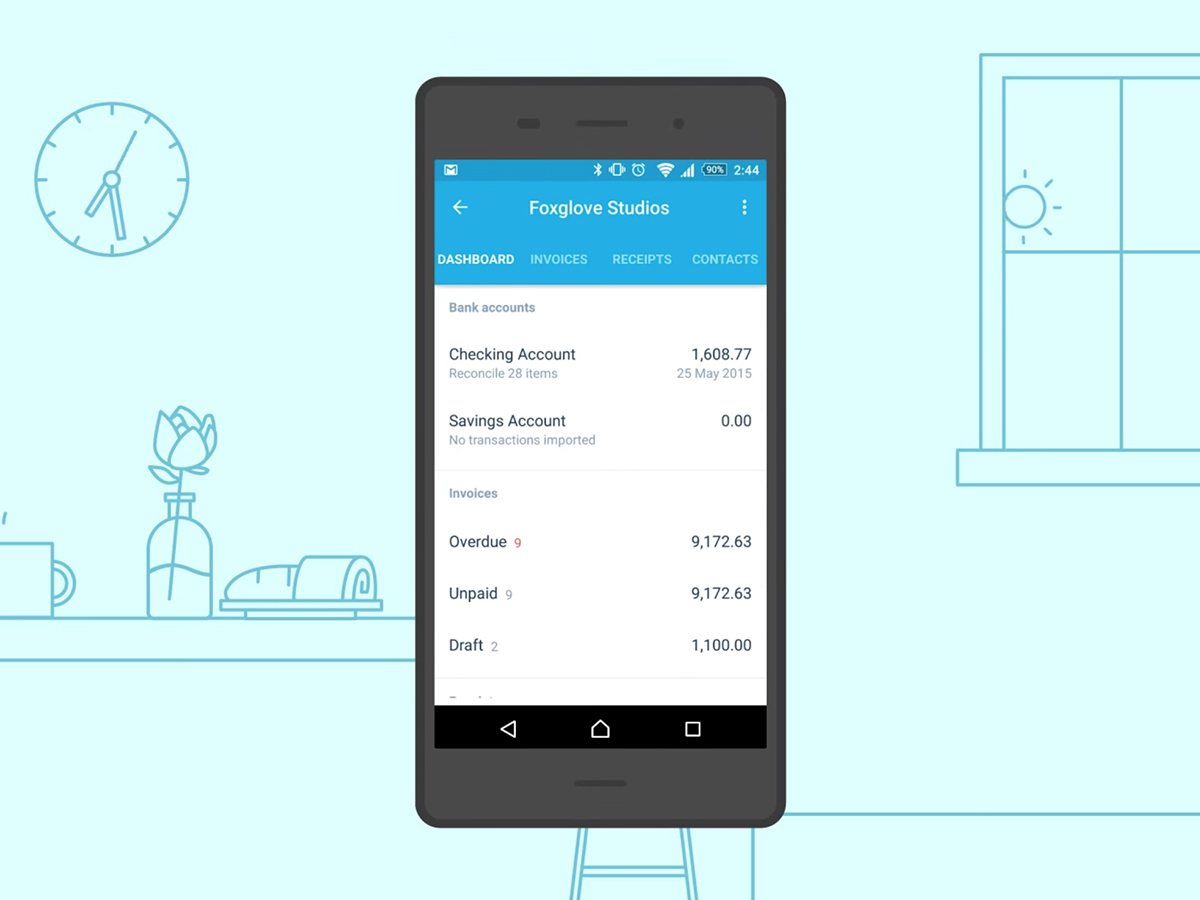

7. Xero

Rather than providing general-purpose accounting, Xero endeavors to help self-employed and freelance workers manage their finances. The app provides tools for everything from issuing invoices to calculating taxes.

Through Xero, you can check your accounts’ balances, reconcile outgoing invoices with incoming payments, and more. Their tools for calculating your expenses are particularly helpful: If you get a gas receipt, for example, you can snap a photo of it with the app to automatically add it as an expense.

However, all of this functionality doesn’t come cheap. Xero plans start at $9 per month for the mobile apps and a very sophisticated web portal. If you’d like to try it out before ponying up, you can explore Xero through a 30-day free trial to see if it works for you.