Financial Traders Look to Boost Profits by Exploiting the Speed of Light for Long-Distance Trades

The speed of light dictates a lot of things in the realm of physics (like the upper limit of the...

The speed of light dictates a lot of things in the realm of physics (like the upper limit of the speed of anything), and now it’s dictating how and where financial institutions do their trading. High-frequency trading that leverages small price differences in the price of a financial instrument trading on two geographically removed markets relies on executing trades extremely quickly, and latencies in fiber optic networks can create competitive advantages and disadvantages. Naturally, investment houses are looking into ways to leverage physics into higher profits.

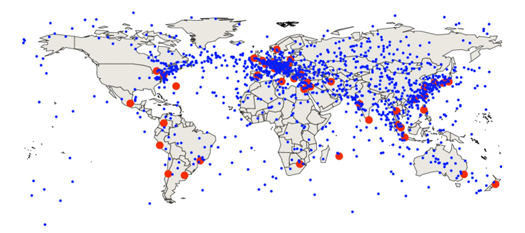

Like physics, finance also has a fundamental principle that is absolute: buy low, sell high. Dr. Alexander Wissner-Gross of Harvard first explored the best way to use fiber optic networks to do this in a 2010 paper, in which he examined locations that are geographically suited for best opportunities to buy low in one market and sell high in another.

But there is a problem. The shortest distance between points is a straight line, and the ideal place from which to execute trades in both markets is exactly halfway in between. For, say, an NYC trading firm looking to exploit price differences between the New York Stock Exchange and exchanges in London or Frankfurt, that locale is in the middle of the Atlantic ocean–a tough place to build a new Wall Street trading floor (there’s not a Brooks Brothers for miles!).

But there are other ways to exploit the latencies in existing fiber optic networks. Dr. Wissner-Gross is now working on finding places that are a good approximation of those mid-ocean points–say, Nova Scotia for trading between New York and London, or perhaps North Africa, or some mid-ocean island chain for trading between New York and Middle Eastern Markets.

Trades already fly around the world at around 90 percent of the speed of light, but Dr. Wissner-Gross believes the first companies to exploit this trick of physics will have a clear-cut competitive advantage that pushes that number higher. More importantly, the next big financial trading hubs may be dictated not by where the buildings are tallest, but by where light-speed networks can execute transactions the fastest, making basic physics a new national resource.