The Treasure of the Safit Chir

For over two centuries we have struggled to understand the scope of Afghanistan's mineral wealth. Now geologists, if they can determine what lies beneath the nation's ground, might also help bring stability to the surface

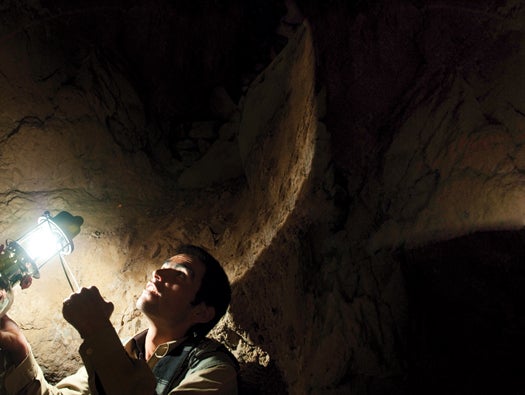

Early one morning in June, just a week after the New York Times reported claims by U.S. officials that Afghanistan was perched atop enough copper, gold, iron, lithium, and assorted rare minerals and gemstones “to fundamentally alter the Afghan economy and perhaps the Afghan war itself,” I made my way with a local guide to the illegal mines of the Safit Chir, an emerald-rich line of ridges 100 miles northeast of Kabul. After a three-hour climb up trails navigable only on foot or by donkey, we greeted several miners, and one of them led us past the dark maws of the tunnels to the edge of a ridge, the better to see the places where his nation’s wealth might be hidden.

As we looked out over steep slopes dotted with purple delphinium, the snow-capped peaks of the Himalayas all around us, Abdul Latif told me that he had not always been a miner. He had become a mujahideen commander after the Soviet invasion in 1979, he said, and he’d faced the enemy’s artillery and helicopters in these very mountains: land mines and the bones of men were buried out there, and older things too. Haroon, another miner, said that while he was digging a new tunnel several years ago he came across ancient buried walls, the chamber of a house made with neat stone masonry. He found a clay amphora there and smashed it in the hopes of finding gold, but it contained only dust.

Afghanistan’s “artisanal” miners, the gem-seeking equivalent of subsistence farmers, have been extracting and exporting precious stones for more than seven millennia; archaeologists have discovered lapis lazuli from Afghanistan in ancient burial sites as far away as Egypt. For the 3,000 or so artisanal miners working today, the job remains difficult. They have no property rights and keep their operations hidden from the central government, which in any case has little control over the region. Fatal accidents from blasting, cave-ins and avalanches are not uncommon, and the miners survive on a diet of stale bread, tea, chickpeas, rice and hashish, brought up once a week by donkey. In the summer they live in small stone huts with tarpaulin roofs; in winter, they move down into the mines themselves. For these efforts, they produce gemstones with a market value of about $2.75 million annually, and probably keep about a tenth of that for themselves.

Afghanistan’s Mineral Wealth

Haroon beckoned us to enter one of the mines, where the air was cooler. Crouching, he led us through a crude system of tunnels that he and others had dug with jackhammers and dynamite. Several hundred feet into the entrails of the mountain, he hunched down and pointed his lamp at a solid stone face. He placed his finger against a thin line of whitish feldspar. “This is the sign of the emeralds,” he said. He scratched at the vein with his chisel and then reached down and picked up a stone encrusted with a faint fuzz of green crystals. “You see? They must be close.”

That there is mineral wealth in Afghanistan is as obvious as the stone in Haroon’s hand. But no one knows just how much. The Times cited a newly arrived Pentagon task force to support the claim that Afghanistan possesses “nearly $1 trillion in untapped mineral deposits,” and the Afghan government itself puts it closer to $3 trillion. But such numbers can’t be found in any published scientific papers. “You can read every one of our reports, and there’s no dollar figure attached to them,” says Jack Medlin, the geologist who coordinated the 2007 U.S. Geological Survey work in Afghanistan that informed the Pentagon estimate.

“From what we can tell, someone took the estimated tonnage and looked up commodity prices for that particular mineral at that time,” Medlin says. “You begin to go through a multiplication and addition process, and someone arrived at a trillion-dollar figure.”

The Pentagon task force estimate also obscured another important fact: Knowing about something is not the same as having it. Geologists and mining professionals carefully distinguish resources—the actual amount of a given material that exists in the ground—from reserves, the amount of that resource that can be extracted at profit with current technology under current conditions. The Pentagon, however, had simply tallied up the current market value of all the minerals buried under one of the most rugged, remote, undeveloped and lawless countries on Earth.

The result, not uncommon in Afghanistan, was the promise of a rich reward with no accounting of what it would take to obtain it. The country desperately needs the resources to rebuild, but future investors will demand a far more careful analysis of the costs and benefits. If scientists can determine what really lies beneath the ground—what can be extracted under the challenging “current conditions” of poverty, chaos and war—perhaps Afghanistan can negotiate its own fate.

* * * *

The Soviet invaders, mindful of the political importance of natural resources, built a fine headquarters for the Afghanistan Geological Survey, on the eastern edge of Kabul, and 21 years after the Soviet withdrawal, the place is still being renovated with international money. When I visited one hot afternoon, workers were applying a fresh coat of paint to the stark concrete exterior.

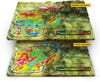

Hidden Afghanistan

_

- This magnetic anomaly indicates the presence of rare-earth metals.

- An area with low magnetic anomalies could contain oil or gas.

- High magnetic anomalies here indicate the presence of copper.

- Low density also suggests oil or gas, reinforcing the data from (2)

_The AGS is responsible for, among other tasks, measuring Afghanistan’s mineral wealth, and the World Bank, which has extended $2 billion in loans to Afghanistan, has taken an interest in the project. I was here to meet two of the experts the bank had sent to assist in the effort. I joined Klaus Steinmüller and Jerry Garry in the sunlit map room, crowded with plotting tables and geological charts, where they had been training Afghan geologists. What was it, I asked them, that made countries rich in minerals in the first place?

“If you’re a mining company, the first thing you do is, you look at the regional setting,” Garry said. “Is Afghanistan sitting in a highly prospective mineral belt? The answer is yes.” He spread out a chart that showed the major faults in the Eastern Hemisphere and swept his hand in a line from the Balkans down past India. “The Tethyan mineral belt starts in Turkey, runs through Iran and then into Afghanistan, and goes all the way across Asia to Indonesia. It’s renowned for holding world-class base- and precious-metals deposits.” Steinmüller broke in and jabbed at the map. “The Tethyan belt is one of the best-understood. But there are many other mineral belts. There’s another one up here,” he said, pointing toward Afghanistan’s northeasternmost corner, where the mountain peaks can reach above 25,000 feet. “Lots of precious metals. There are many other belts like that, but they’re not well-understood yet.”

The existence of such mineral belts and the difficulty in analyzing them both owe in part to the violent collision of the Indian-Australian and Eurasian tectonic plates, which began some 50 million years ago and which still pushes the Himalayas up by nearly an inch every year. That collision has made the mountainous regions of Afghanistan some of the most rugged on Earth—tough places for surveying minerals and fighting insurgencies alike.

The collision also drained away the prehistoric Tethys Ocean, even as it opened fissures that drew magma to the surface. This is, from the perspective of mineral prospectors, an enticing combination. Magma draws up heavy elements (iron, copper, gold) from the Earth’s mantle and, as it cools, also crystallizes into emeralds and rubies. Meanwhile, the prehistoric seabeds, laden as they are with organic sediment, promise significant oil and gas deposits.

“This country is rich. Everybody knows this,” Garry concluded. “But in order to understand this kind of mineral endowment, you need to undertake systematic exploration.”

* * * *

Afghanistan’s potential wealth has long been studied with interest by its ruling powers. The first scientific exploration of the land came with British invasions in 1839 and 1878, and the first systematic surveying efforts began in the mid-20th century, when French, German, Italian and Soviet geologists, at the invitation of King Zahir Shah, traveled the nation on foot and donkey-back, taking rock samples by hand. It was the Soviet invaders, though, who conducted what remain the most extensive ground surveys: They used drilling, trenching, and field samples to evaluate 20 sites in detail, paying special attention to the large Aynak copper deposit south of Kabul and the even larger Hajigak iron deposit in the Hindu Kush. After the Soviet withdrawal in 1989, all geological work came to a halt. In 1995, as the Taliban massed on the outskirts of Kabul, the staff of the AGS did manage to compile most of the previous research, and when the Taliban took Kabul a year later, the staff hid the documentation in their homes, where it remained until the current occupation.

Resource Infographic

In 2004, American and British geologists began training the staff of the AGS to conduct surveys using global positioning satellites and modern field laboratories. They also began entering the data from the old Soviet reports into computer databases, converting it to correspond to international data standards, and verifying the Soviet geologists’ original sampling material, thereby bringing that decades-old picture of Afghan wealth into greater focus.

Still, significant areas of the country had yet to be studied. A team of USGS geologists delivered a briefing in Kabul to the staff of then-ambassador Zalmay Khalilzad, with a particular focus on the petroleum-producing potential of the Sheberghan region in the north. The ambassador’s staff, however, was more interested in knowing if there might be undiscovered wealth in areas that were seen as susceptible to Taliban influence. “The question was: Is there any potential for oil and gas in the southern part of the country? Because that would be critical,” recalls Medlin, the USGS geologist. The presence of natural wealth, it was thought, could attract large-scale development that, in addition to growing the national economy and enhancing the authority of the central government, might employ the people of that unstable region in something other than insurgency.

Necessary Resources

The administration of Afghan president Hamid Karzai determined that additional research was needed and gave the USGS $8.86 million to get started. The USGS in turn solicited approximately $15 million from USAID and other international donors. The problem was that the most promising “frontier basins”—possible oil- and gas-bearing rock regions—were in the most forbidding terrain in the south and southeast, along the Pakistan border. No one from the USGS was going in by road. “These places being in locations where for security reasons you couldn’t get in,” Medlin says, “you need some remote instrument that will allow you to explore it from above.”

The answer was air power. But remote sensing, no matter how sophisticated, would still present major obstacles. The first was that no private surveyors were willing to risk their crews or equipment in a war zone. The solution: The USGS subcontracted the fieldwork to the U.S. Naval Research Laboratory and NASA.

The survey began with a series of flights by geologists in a Navy NP-3D Orion equipped with dual gravimeters and a magnetometer. Security was always a concern, especially given that the CIA, in the 1980s, had equipped Afghan insurgents with hundreds of surface-to-air missiles to use against the Soviet army. The Department of Defense required the pilots to fly at a standoff distance of at least 12,000 feet vertically aboveground and horizontally away from nearby mountain ranges. Since specialized survival gear would have been required for the crew to go more than 26,000 feet above sea level, the surveyors were not able to examine the 30 percent of the country that was more than 14,000 feet above sea level. It also meant that the survey results were less detailed. “You want to go lower and slower,” Medlin says. “Ideally less than 3,000 feet.”

For the second part of the survey, completed in October 2007, Air Force and NASA pilots crisscrossed the country at 50,000 feet in a modified WB-57 Canberra jet bomber equipped with a hyperspectral 3-D-mapping sensor. The USGS geologists complemented this overflight data with images from the NASA-run LANDSAT and Japanese-run ALOS satellite systems, and also with a series of radar surveys from a space shuttle mission in 2000.

In the end, the USGS remote-sensing project helped to confirm and expand on the older data. It indicated that the Hajigak iron deposit was much larger than previously believed and further suggested the presence of oil and gas deposits in southern and southeastern Afghanistan. But remote surveys can only tell you so much. The WB-57 Canberra sensor, for instance, could only create images with a resolution in which each pixel represented a square about 50 feet across—sharp enough to pick up useful data patterns, but still at best merely suggestive.

Ultimately, understanding which minerals are present in what concentrations in Afghanistan will require field research. Medlin says the USGS is hoping that Afghan geologists will one day be able to do that work themselves. “We are training them,” he adds, “because they are the ones who can get out into the countryside.”

* * * *

Back at the Afghanistan Geological Survey, in a half-renovated office down the hall from the World Bank team, Abdul Rahman Ashraf sat hunched over a desktop PowerPoint presentation, occasionally sketching on a pad of paper to illustrate the wavy lines of rock formations—clines and anticlines—that inform decisions about where and when to begin extraction. Ashraf spent most of his career as a geologist abroad, but now he is Karzai’s chief adviser on energy and mines. His job is to bring the country’s mineral-extraction infrastructure up to international standards. “This is Stone Age stuff they’re practicing out there,” he said, referring to the methods of artisanal miners like Haroon and Abdul Latif. “The blasting shatters the emerald crystals and damages their value. But people have learned in these past 20 years to go fast and take what they can.”

Ashraf hopes to change that by opening the nation to long-term investment in mining technology and infrastructure. At Peru’s Antamina mine site, for instance, miners on a 15,000-foot mountain ridge send copper and zinc ore on a conveyor belt to an intermediary plant, where it is crushed into a slurry that can be sent through a nearly 200-mile pipeline that terminates at the port of Punta Lobitos. Such systems are not especially complicated, but they are massive, and making them a reality in Afghanistan will require a commensurately massive investment.

Attracting such investment may prove the greatest challenge of all. Even by the turbulent standards of the Karzai administration, the Ministry of Mines has seen rapid turnover (there have been six appointed ministers since 2002), and it has gained a reputation as one of the most corrupt agencies in Kabul. In 2007 the completion of the largest private foreign-investment deal in Afghan history—a $2.9-billion contract with the China Metallurgical Group Corporation to extract the Aynak copper—was marred by accusations that one of those former ministers had accepted a $30-million bribe from the company.

Ashraf is quick to point out, though, that the company, which is owned by the Chinese government, had offered more in direct foreign investment than any of the other bidders, some $2.8 billion. It had also agreed to build Afghanistan’s first railroad, running from Uzbekistan through Kabul and over the Hindu Kush to Pakistan. In fact, the rapid growth of neighboring China and India could provide Afghanistan the opportunity to develop its own infrastructure, and ultimately to open up the whole region.

And the Chinese government has already funded the construction of a Pakistani deepwater port at Gwadar. India and Iran, meanwhile, are working together to build roads from southwestern Afghanistan to the competing Iranian deepwater port at Chabahar. It’s not the desire to defeat the Taliban, or the need for a political friend in an unstable region, or the hope for peace that will inspire such partnerships. It’s what’s in the ground.

And so real surveying leads to real investment, which in turn leads to real roads, real jobs and eventually—perhaps—real peace. But precise information about Afghanistan’s mineral reserves is still scarce. The Hajigak iron ore deposit, which at upward of two billion tons is the largest in Asia, is due to be opened for bids this month, but mining experts expect many years to pass before other major deposits in Afghanistan are adequately surveyed.

It’s hard to have patience after these dark years,” Ashraf said, looking down again at his careful sketches of Afghanistan’s geologic inheritance. “But we cannot make these things tomorrow.”

Matthieu Aikins is a freelance writer and photographer based in New York.